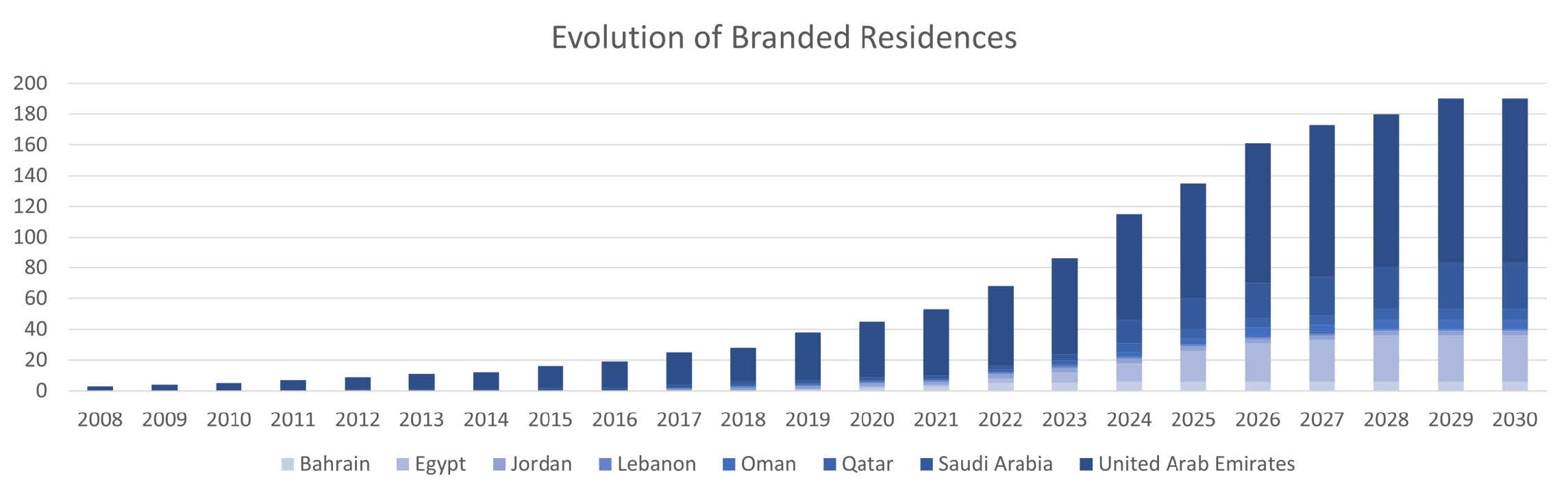

The Middle East has rapidly become a global hotspot for branded residential activity. Dubai remains the most active market globally, while Saudi Arabia added 65% to its branded residential development pipeline between 2022 and 2023.

According to the most recent data published by Savills on branded residences, the total number of projects in the Middle East was fast approaching 200 branded developments across 80 different brands, featuring roughly 45,000 residential units of varying models and typologies.

The branded residential sector has demonstrated accelerated growth in the region, which includes eight countries active in the development of this asset class. Over the course of the last five years, new deals have been executed at the rate of 25 to 30 projects annually.

The value proposition

Real estate developers continue to appreciate the compelling value proposition of branded residences, and brands are similarly dedicating resources to the expansion of their branded residential portfolios. As the number of globally affluent individuals increases, the market for prospective purchasers and subsequent residence owners increases in tandem, and the desire for the lifestyle nature of luxury living is contagious.

When structured in a thoughtful and meaningful way, each of the stakeholders will benefit from the relationship in a highly value-accretive manner that could otherwise not be realised in the absence of any one of the three stakeholders.

At the forefront of what makes branded residences compelling is the accelerated sales absorption and the average 30% premium that such residences command globally, but this merely scratches the surface of how licensing a brand to a residential development appeals to developers.

Brands, meanwhile, benefit from a more profound and meaningful relationship with their loyal brand followers, and residence owners confide in their brands and find tremendous comfort and convenience in such lifestyle products, yet even these benefits remain the tip of the iceberg.

With such an active pipeline and developers increasingly pursuing branded, mixed-use developments and, in some cases, standalone residences, engaging the right professionals to provide support throughout the brand procurement and contract negotiation stages is paramount.

Aligning the developer’s vision with the real estate programme, considering brand suitability, and understanding the operational and commercial implications of licensing a brand to a residential development through real-world experience requires thoughtful consideration and a little perspective.

A mixed-use branded residential project is attractive to developers as the sale of such branded residences during the development period (with funds held in escrow as per local law requirements) can serve as an effective source of financing, whilst producing for the brand royalty fees and a recurring income stream.

The suite of legal agreements includes, but is not limited to, brand licence agreements, residential management agreements, and in the case of mixed-use developments, the accompanying hotel management agreements. These agreements can range from fewer than 100 pages to several hundred pages. Engaging the right stakeholders to support throughout the brand procurement and contract negotiation processes can require, on average, between three to six months.

Mixed-use branded residences and standalone branded residence projects are where global hospitality meets local real estate law. It is important, for both developers and brand companies alike, that the suite of legal agreements complies with local real estate law, enables developers to achieve their sales objectives, and enables brand companies to achieve their requirements for ensuring that the projects are built and maintained in accordance with the brand standards.

Typically, brands will require developers to appoint the developer, an affiliate of the developer, or a third-party building/association management company approved by the brand company as the building or association manager for the project. This provides assurance to the brand that the entity tasked with managing the project is aligned with the interests of the brand and/or has particular expertise in managing branded residential developments.

In the following two sections, the positions in Dubai and Saudi Arabia are more closely examined.

Branded residences in Dubai

In Dubai, mixed-use projects that typically include a hotel component can be classified as a category 2 hotel project under the jointly owned property law, giving the developer the right to appoint the building manager, subject to the approval of the Real Estate Regulatory Agency (RERA), which is the local governing authority.

The position in standalone branded residential projects is different as the developer generally does not have the right to appoint the building manager, as that right is reserved to RERA under the jointly owned property law. In such cases, the branded residence units are typically sold on the basis that the branding of the residential project is conditional on certain circumstances, including that a building manager acceptable to the brand is appointed and the brand’s physical and operational standards are maintained at the branded residential development throughout the entirety of the term.

One way for a brand to satisfy itself that a branded residential project will be maintained to the brand standards is for the developer (in its capacity as the hotel owner) to enter into an agreement with the building manager for the hotel owner to provide (or arrange for the provision of) designated brand services, including but not limited to concierge, housekeeping, façade cleaning, and much more. Such services would be provided under the supervision, direction, and control of the brand under a separate back-to-back agreement between the hotel owner and the brand/operator appointed to manage the hotel component.

For standalone branded residential projects, often the brand company requires the developer to retain ownership of one or more units (such as a clubhouse or a food & beverage unit) that will enable the developer to retain a residual interest in the project, thereby giving it the capacity to enter into an agreement with the building manager to provide the designated brand services, again under the supervision, direction, and control of the brand under a separate back-to-back agreement between the developer and the brand.

Branded residences in Saudi Arabia

In the Kingdom of Saudi Arabia, an independent owners’ association management industry is in its nascent stages, and the developer or its affiliate will typically act as the association manager for the owners’ association that will be established with respect to the branded residential project.

Some brands prefer to act as association managers themselves so that they have direct control in ensuring that the branded residential project is operated and maintained to the brand standards.

The Ritz-Carlton Residences Diriyah

The form of the sales documentation must be approved by Wafi, which is the off-plan sale or rent committee for the Kingdom of Saudi Arabia, whose competence was relatively recently transferred from the Ministry of Municipal and Rural Affairs to the Real Estate General Authority (REGA). Accordingly, the sales documentation form will need to align with Wafi’s requirements.

However, in our experience, Wafi will agree to the inclusion of provisions in the sales documentation that enable the brand requirements for the project to be met. These provisions include attaching the agreed forms of any governance documents that include positive covenants to maintain the brand standards at the branded residential project and requiring the owners’ association (or the association manager on its behalf) to enter into a designated brand services agreement with the hotel owner, under the supervision, direction, and control of the brand company under a separate back-to-back agreement with the brand.

The support of the local regulators in Dubai and Saudi Arabia has been important in marketing and promoting the sale of branded residences as an important component of the tourism and real estate sectors in those markets. The result of the visionary leadership from both key markets will help to reinforce the Middle East as an especially active market for branded residences.

For more support and information on all aspects of branded residential development in the Middle East, readers are encouraged to consult the impressum.

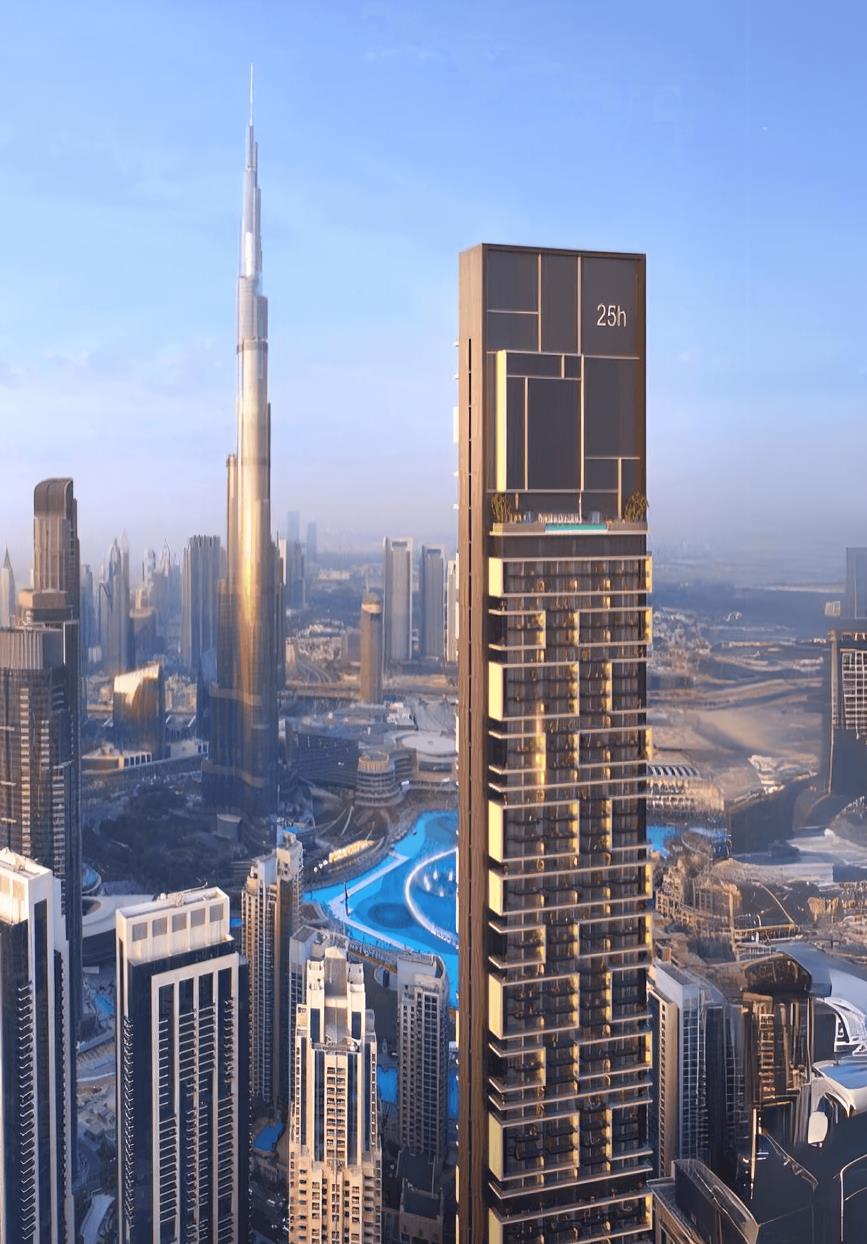

25hours Heimat Downtown Dubai

About Wisefields

Wisefields is a specialist law firm with a singular focus on the real estate, hotels, and tourism industry. Established by the two leading real estate and hotel lawyers in the Middle East, Bilal Ambikapathy and Moustafa Said, the only two lawyers in Saudi Arabia consistently ranked by legal directories year after year as leading individuals with tier 1 practices in the real estate sector in Saudi Arabia. Both Moustafa and Bilal are Australian-qualified lawyers who have worked in tier-1 Australian, British, and American law firms throughout their careers. They bring extensive international experience with deep local knowledge in the context of the dynamic and rapidly evolving real estate, hotels, and tourism landscape in the Middle East.

About Savills

Savills Global Residential Development Consultancy has an extensive track record advising a range of clients, including institutional, corporate, and private clients, on their branded residential strategy. Based in the Savills global headquarters in London, the team has an international remit working in conjunction with the Savills network across the globe to ensure advisory services take into consideration both local and international market dynamics and trends. The specialist team provides a range of professional services for branded and non-branded residential, hotel, and integrated resort projects, from luxury small-scale resort developments to large, mixed-use urban regeneration projects.

Since its inception, the global residential development team has grown from strength to strength to now be considered market leaders and thought pioneers in the luxury and branded residential sectors. Savills is constantly updating sector intelligence and its market-leading research for clients that feeds into feasibility reports and brand premium studies. This broad service offering is enhanced by the network that has been established in the last decade with brands, developers, and investors who are active in the branded residential sector. As a central point of contact for these parties, Savills is ideally positioned to negotiate hotel and residential licence and management agreements.